Let’s talk money—specifically, the money your cleaning business deserves to keep.

If you’re running a cleaning business and not strategically maximizing your tax deductions, you’re essentially tossing cash into the same bins you empty for clients. Ironic, right?

After working with hundreds of service-based businesses over the years, I’ve discovered something that might surprise you: the average cleaning business owner misses out on thousands of dollars in legitimate deductions every tax season. This isn’t clever accounting—it’s about claiming what’s rightfully yours.

The Real Deal About Taxes in the Cleaning Industry

Here’s what nobody tells you when you start your cleaning business: The government actually wants you to take legitimate deductions. The tax code is designed to incentivize business activities and investments—but only if you know how to play the game.

The average cleaning business operates on a 20-40% profit margin. When you’re working with those numbers, every single dollar matters. Missing deductions isn’t just a minor oversight—it’s undermining the growth potential of your entire operation.

The Big 5 Tax Deductions Every Cleaning Business Must Know

Let’s get specific. Here are the five major deduction categories that can transform your cleaning business’s tax situation:

1. Cleaning Supplies & Equipment (The Obvious Stuff)

Of course, your cleaning supplies are deductible—that’s basic. But what’s not basic is how you track and categorize them:

- Consumables vs. Capital Equipment: Supplies that get used up within a year (cleaning solutions, cloths, disposable items) are immediately deductible. Equipment expected to last more than a year follows depreciation rules.

- Pro Tip: Consider Section 179 deduction for major equipment purchases, which allows you to deduct the full purchase price of qualifying equipment in the year you buy it, rather than depreciating it over time. Think vacuum cleaners, floor buffers, steam cleaners, or even company vehicles.

- Real Talk: If you’re not scanning and categorizing every single receipt for cleaning supplies, you’re playing a dangerous game. Your business lives and dies by these supplies—treat the deductions with the same respect.

2. Vehicle Expenses (The Game-Changer)

For cleaning businesses, this is often the most underutilized deduction category:

- Standard Mileage vs. Actual Expenses: You can deduct 67 cents per business mile in 2024 using the standard deduction, or track actual vehicle expenses like gas, insurance, repairs, and depreciation.

- The Numbers Don’t Lie: A cleaning business with 3-5 service vehicles driving to multiple locations daily can easily rack up 20,000+ business miles per year. At 67 cents per mile, that’s a $13,400 deduction—just for driving to your jobs!

- Tracking is Non-Negotiable: If you’re not using a mileage tracking app that logs every single business trip, you’re playing with fire. The IRS loves to challenge vehicle deductions that don’t have immaculate records.

3. Labor Costs (The Big One)

Whether you have employees or contractors, this category represents huge deduction opportunities:

- Employee Wages: 100% deductible, including overtime and bonuses.

- Contractor Payments: Fully deductible, but make sure you’re classifying workers correctly and issuing 1099s when required.

- The Hidden Gem: Training costs for your cleaning staff are fully deductible. This includes formal training programs, certifications, safety training, and even specialized cleaning technique workshops.

- Reality Check: The cleaning industry sees some of the highest worker turnover rates. Every time you onboard someone new, those training costs are deductible. Document everything.

4. Insurance Premiums (The Non-Negotiable Protection)

Running a cleaning business without proper insurance is like jumping out of a plane without a parachute. Luckily, all these essential protections are tax-deductible:

- General Liability Insurance: Covers damage to client property—critical for cleaning businesses and 100% deductible.

- Workers’ Compensation: Required in most states and fully deductible.

- Commercial Auto Insurance: Covers your service vehicles and is fully deductible.

- Bonding Insurance: Protects clients from theft and is especially important for residential cleaning businesses.

- Power Move: Consider bundling insurance policies for better rates, but keep detailed breakdowns for maximum deduction documentation.

5. Home Office & Administrative Expenses (The Overlooked Gold Mine)

Even if you’re primarily in the field cleaning, your administrative base deserves serious deduction attention:

- Home Office Deduction: If you run your cleaning business from home, you can deduct a portion of your rent/mortgage, utilities, internet, and phone based on the percentage of your home used exclusively for business.

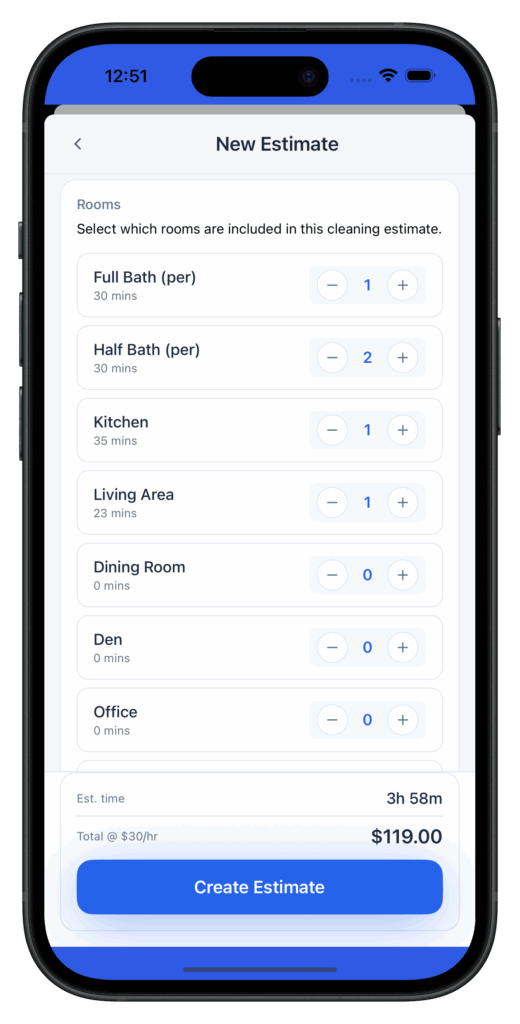

- Software Subscriptions: Scheduling software, accounting programs, and business apps are fully deductible. (Hint: MaidManage falls into this category!)

- Marketing Costs: Every dollar spent on business cards, website development, local ads, and even social media promotion is 100% deductible.

- The Accountability Factor: The cleaning businesses that track these expenses meticulously generally outperform those that don’t. This isn’t coincidence—it’s a discipline that translates to all areas of business.

The Deductions Most Cleaning Businesses Miss

Now let’s talk about the deductions that your competitors are almost certainly overlooking:

Professional Development

- Subscriptions to cleaning industry publications

- Business books and educational materials

- Conferences and trade shows (including travel expenses)

- Business coaching and consulting services

Client Appreciation

- Holiday gifts for regular clients (up to $25 per person)

- Thank-you cards and client appreciation materials

- Referral rewards and incentives

Banking and Financial Costs

- Merchant processing fees from client credit card payments

- Business bank account fees

- Interest on business loans or credit cards used for business expenses

- Accounting and bookkeeping services

Health Insurance Premiums

If you’re self-employed, you may qualify to deduct 100% of your health insurance premiums as an above-the-line deduction, which reduces your adjusted gross income.

The Tax Organization System That Will Transform Your Cleaning Business

Let me give you the exact system I recommend to every service business owner:

- Dedicated Business Accounts: Keep separate business checking and credit card accounts—never commingle personal and business funds.

- Real-Time Expense Tracking: Use a cloud-based accounting system that connects to your business accounts and allows for mobile receipt scanning.

- Weekly Financial Reviews: Set a non-negotiable 30-minute appointment with yourself every week to categorize transactions while they’re fresh in your mind.

- Quarterly Tax Planning: Work with a tax professional who specializes in small businesses (ideally service businesses) to review your situation quarterly, not just at tax time.

- Documentation Protocols: Create standard procedures for how every expense is recorded, categorized, and stored. The cleaning business runs on systems—your tax documentation should be no different.

The Hard Truth You Need to Hear

Here’s something I tell every cleaning business owner I consult with: The difference between overpaying taxes and legally minimizing your tax burden comes down to one thing—systems.

Think about it. You’d never send a cleaning team to a job without proper supplies, checklists, and quality control measures. So why approach your taxes with no system at all?

I’ve noticed that the cleaning companies that consistently outperform their competition treat tax planning with the same seriousness as landing new clients. Both directly impact your profitability in significant ways.

The Action Plan Every Cleaning Business Owner Needs to Implement Today

- Audit Your Current Tracking: How are you currently tracking expenses? Is it comprehensive? Is it real-time? If not, fix this immediately.

- Schedule a Mid-Year Tax Review: Don’t wait until tax season. Find a tax professional who understands service businesses and schedule a review now.

- Implement a Mileage Tracking Solution: If your cleaning teams are on the road and you’re not tracking every mile, start today. The deduction value is too significant to ignore.

- Review Your Entity Structure: Are you operating as a sole proprietorship, LLC, or S-Corporation? Each has different tax implications. Make sure your entity structure aligns with your tax goals.

- Create a Tax Documentation Checklist: Develop a simple checklist that ensures you’re capturing every possible deduction throughout the year.

The Bottom Line

Your cleaning business operates in a competitive industry with tight margins. Tax strategy isn’t just about compliance—it’s a crucial component of your profitability.

The most successful cleaning business owners I know don’t see tax planning as a necessary evil. They view it as a profit center—a strategic area where small improvements yield massive results.

Every dollar saved in legitimate tax deductions is another dollar you can invest back into growing your cleaning empire—better equipment, more marketing, additional staff, or simply more profit in your pocket.

The question isn’t whether you can afford to focus on maximizing your cleaning business tax deductions. The question is: Can you afford not to?

Disclaimer: This article provides general information about tax deductions potentially available to cleaning businesses. Tax laws change frequently and vary by location. Please consult with a qualified tax professional regarding your specific situation before making tax-related decisions.